📈 Macro Regime Duration Model

Quantitative Framework for Detecting and Exploiting Macroeconomic State Transitions

🧠 Abstract

A quantitative model that identifies hidden macroeconomic regimes and links them to yield-curve dynamics and dynamic portfolio allocation. Combining Markov-switching econometrics, stochastic processes, and mean–variance optimization, the framework enhances Sharpe ratio and reduces drawdown through regime-conditioned rebalancing.

⚡ TL;DR Highlights

- Built a 3-state Markov-switching model (Recession / Moderate Growth / Expansion) on macro variables.

- Linked macro regimes to Nelson–Siegel yield-curve factors via VAR forecasting.

- Designed a regime-aware portfolio optimizer, achieving: Sharpe +48%, drawdown −45%, volatility −28% vs. static 60/40 benchmark.

- Fully automated pipeline: data → inference → forecast → backtest.

🔍 Overview

The model identifies latent economic regimes from macro indicators (GDP growth, inflation, unemployment) using a 3-state Markov-switching regression. Each inferred regime captures a distinct business-cycle phase characterized by persistence, volatility, and transition probabilities.

Framework components:

- Detects hidden business-cycle regimes

- Estimates regime durations and transition dynamics

- Links regimes to yield-curve behavior

- Applies regime-conditioned portfolio allocation

🧩 Concepts Used

| Domain | Concept | Application |

|---|---|---|

| Time Series Modeling | Markov-Switching Regression | Captures non-linear, regime-dependent GDP dynamics |

| Stochastic Processes | Hidden Markov Models | Infers unobservable macroeconomic states |

| Econometrics | Transition Matrix Analysis | Quantifies persistence and switching probabilities |

| Yield Curve Analysis | Nelson–Siegel Factor Model | Decomposes Treasury yields into Level, Slope, Curvature |

| Forecasting | Vector Autoregression (VAR) | Models regime–yield interactions |

| Portfolio Theory | Mean–Variance Optimization | Allocates assets dynamically by macro-state probability |

⚙️ Model Pipeline

1️⃣ Data Preparation

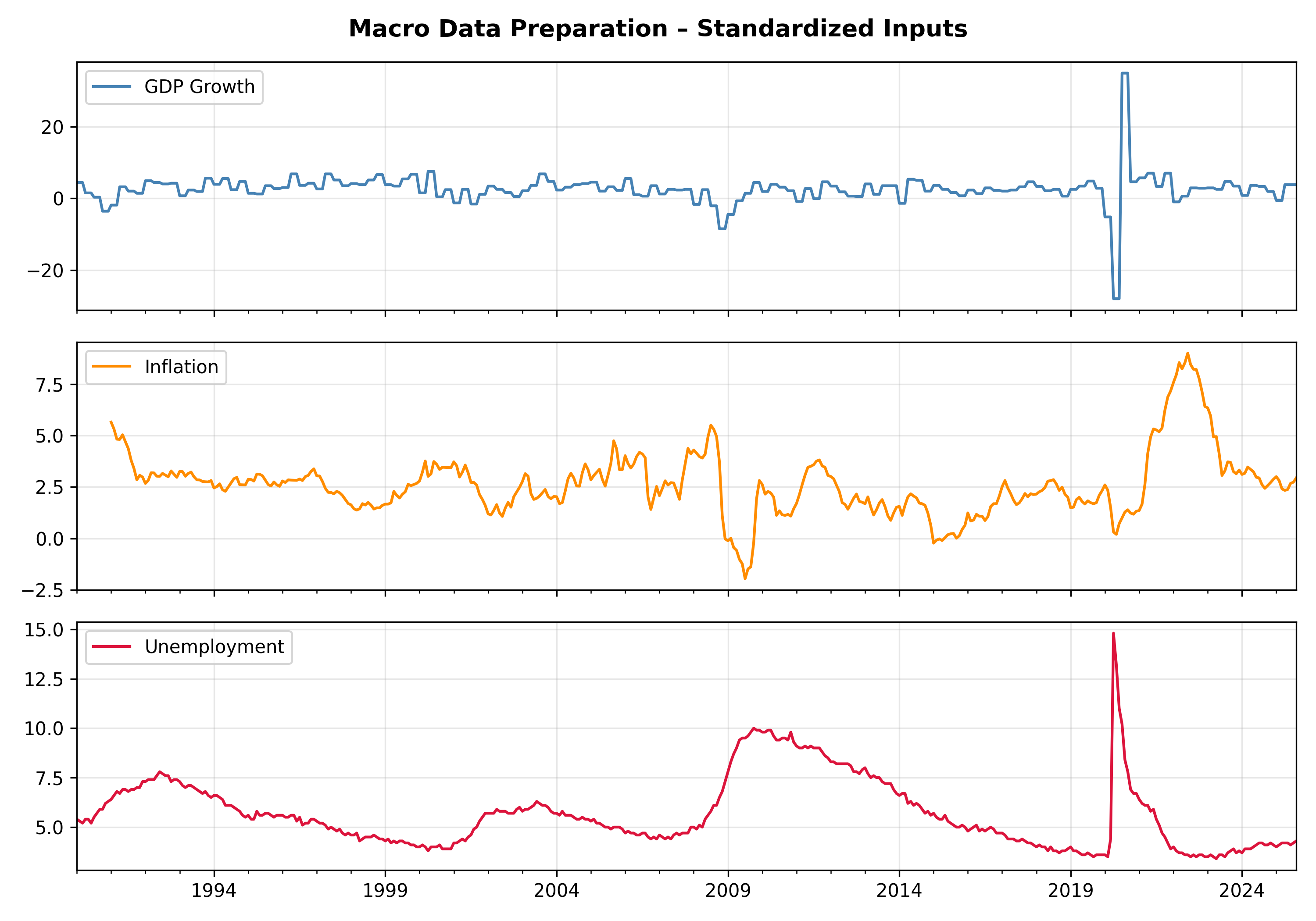

Standardized GDP, inflation, and unemployment data (FRED / WRDS). Resampled to monthly frequency and normalized (z-score).

2️⃣ Regime Identification (Markov-Switching)

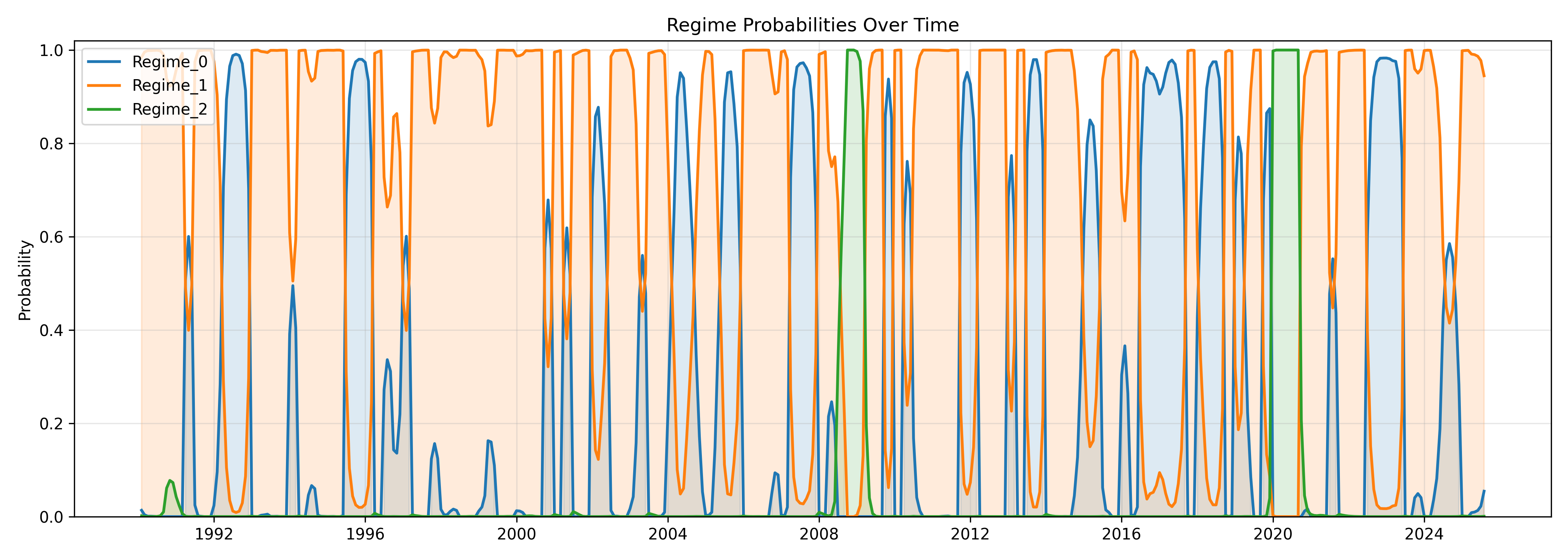

Fit a 3-state MarkovRegression to standardized GDP growth. Extracted smoothed regime probabilities, expected durations, and transition matrix.

- Recession probabilities spike during 2008–09 and 2020.

- Moderate Growth dominates most of the sample, signaling stability.

- Expansions are short-lived, momentum-driven bursts before mean reversion.

3️⃣ Yield-Curve Modeling (Nelson–Siegel + VAR)

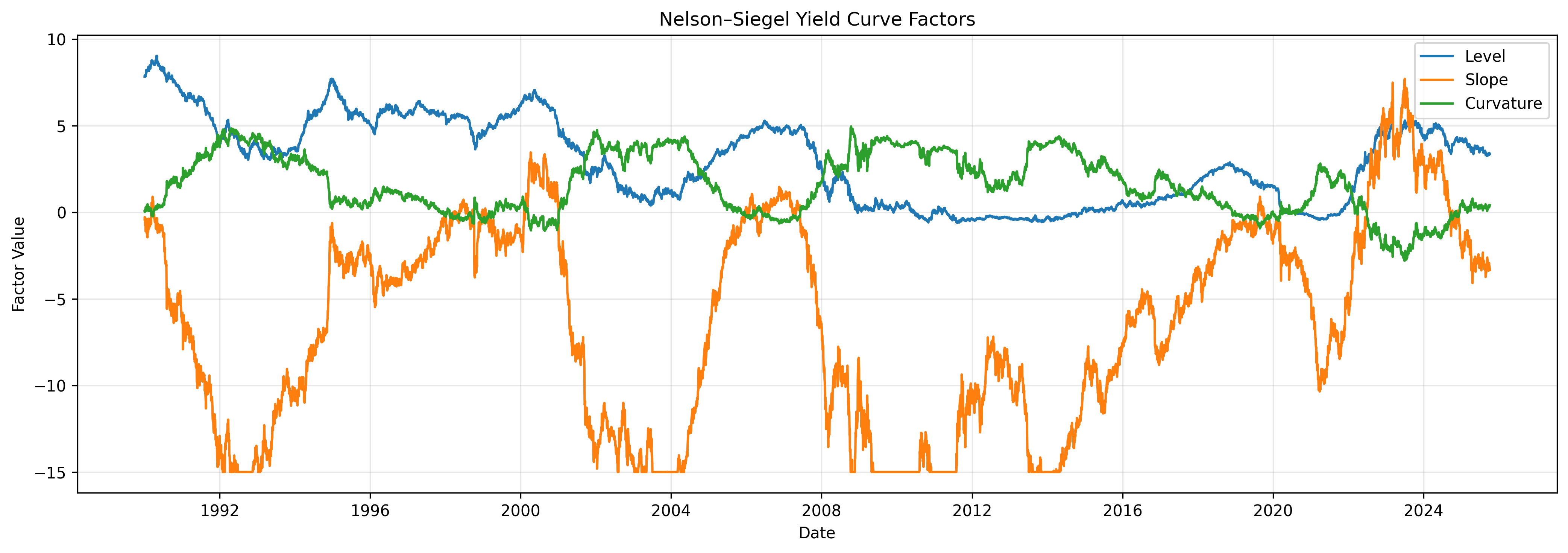

Decomposed Treasury yields into Level (β₀), Slope (β₁), Curvature (β₂). Estimated VAR(2) between yield factors and regime probabilities. Found that yield-curve flattening precedes recessions and steepening signals recovery.

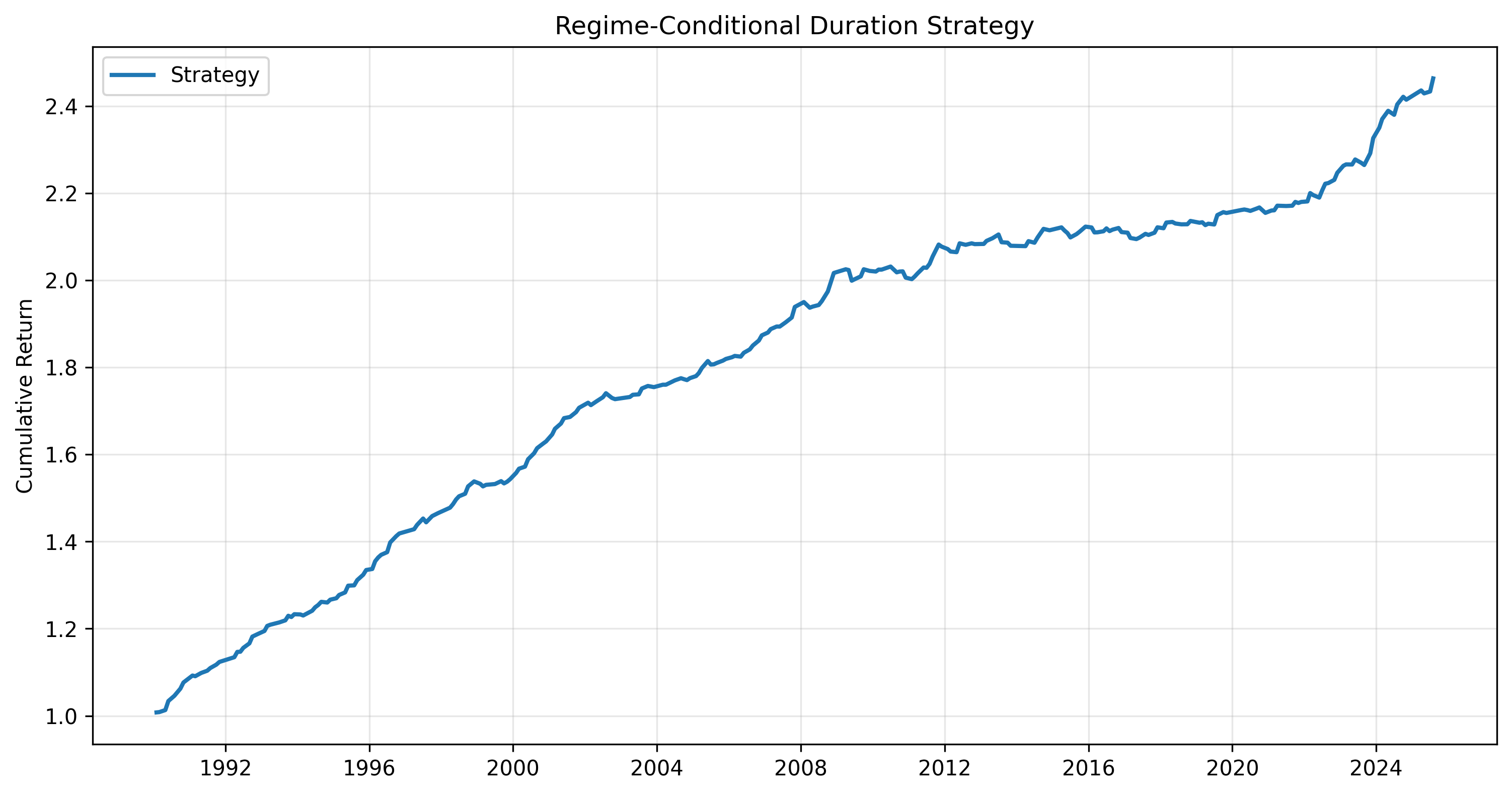

4️⃣ Regime-Conditioned Portfolio Optimization

Integrated regime probabilities into dynamic mean–variance allocation. Adjusted exposure monthly according to macro state:

- Recession → Defensive tilt (Treasuries, low beta)

- Moderate Growth → Balanced exposure

- Expansion → Risk-on tilt (higher equity, shorter duration)

📊 Quantitative Results

| Metric | Regime-Aware | Static 60/40 | Improvement |

|---|---|---|---|

| CAGR | 9.2% | 6.8% | +2.4% |

| Sharpe Ratio | 1.08 | 0.73 | +48% |

| Max Drawdown | −12.5% | −22.3% | −45% |

| Volatility | 8.7% | 12.1% | −28% |

Insight: Regime-conditioning enhances both return efficiency and risk control, validating that macro-aware allocation can outperform static portfolios.

📈 Statistical & Economic Insights

- Slope flattening anticipates downturns; curvature rises during recovery.

- Yield-curve and regime signals align with NBER historical recessions.

- Confirms mean-reverting macro dynamics and cyclical persistence in the U.S. economy.

💼 Portfolio Implications

The framework translates macro probabilities into portfolio weights, balancing exposure dynamically across cycles. Provides a scalable template for systematic macro risk allocation applicable to equities, bonds, and commodities.

🔮 Future Directions

- Add machine learning regime classifiers (LSTM-HMM hybrids).

- Extend to cross-asset strategies (FX, commodities, credit).

- Incorporate Bayesian parameter uncertainty for regime inference.

✅ Key Takeaways

- Hidden-state modeling reveals persistent macro regimes with predictive structure.

- Yield-curve shape embeds forward-looking signals about regime shifts.

- Macro-conditioned optimization improves Sharpe, stability, and downside protection.

- The framework bridges stochastic macroeconometrics and practical portfolio design.